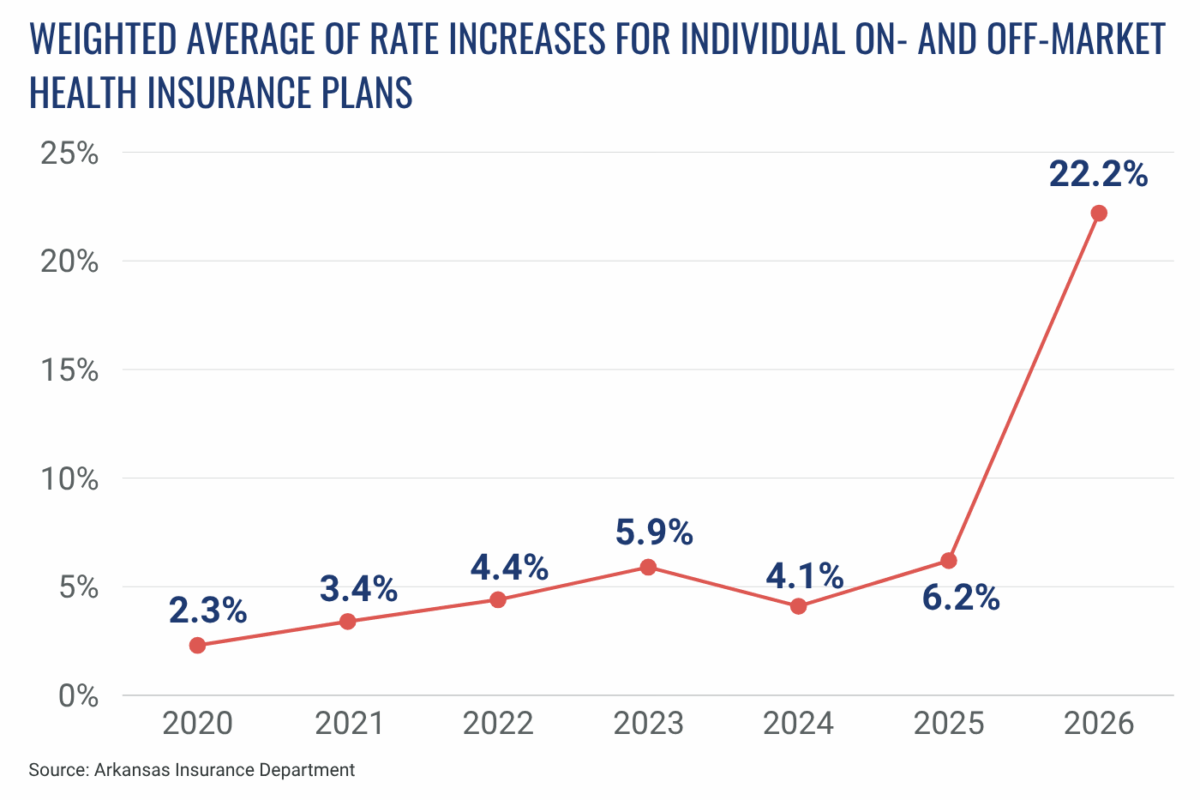

The Arkansas Insurance Department (AID) has approved an average rate increase of 22.2% for individual health plans for the 2026 plan year. This is down from a 36.1% average increase that insurers previously proposed but withdrew in the face of opposition from Gov. Sarah Huckabee Sanders. The approved rates were first announced by Sanders in a September 19 news release.

The rate increases approved by AID are the third set of increases that Arkansas insurers proposed for 2026. In June, insurers filed proposed increases that, weighted for market share, amounted to an average increase of 26.2% for individual on- and off-market plans — i.e., individual plans offered through the Arkansas Health Insurance Marketplace and individual plans offered outside the marketplace. Insurers refiled in August, proposing an unprecedented average rate increase of 36.1%. AID ultimately approved an average rate increase of 22.2% — substantially lower than what insurers proposed in August, but still the largest one-year increase on record in Arkansas.

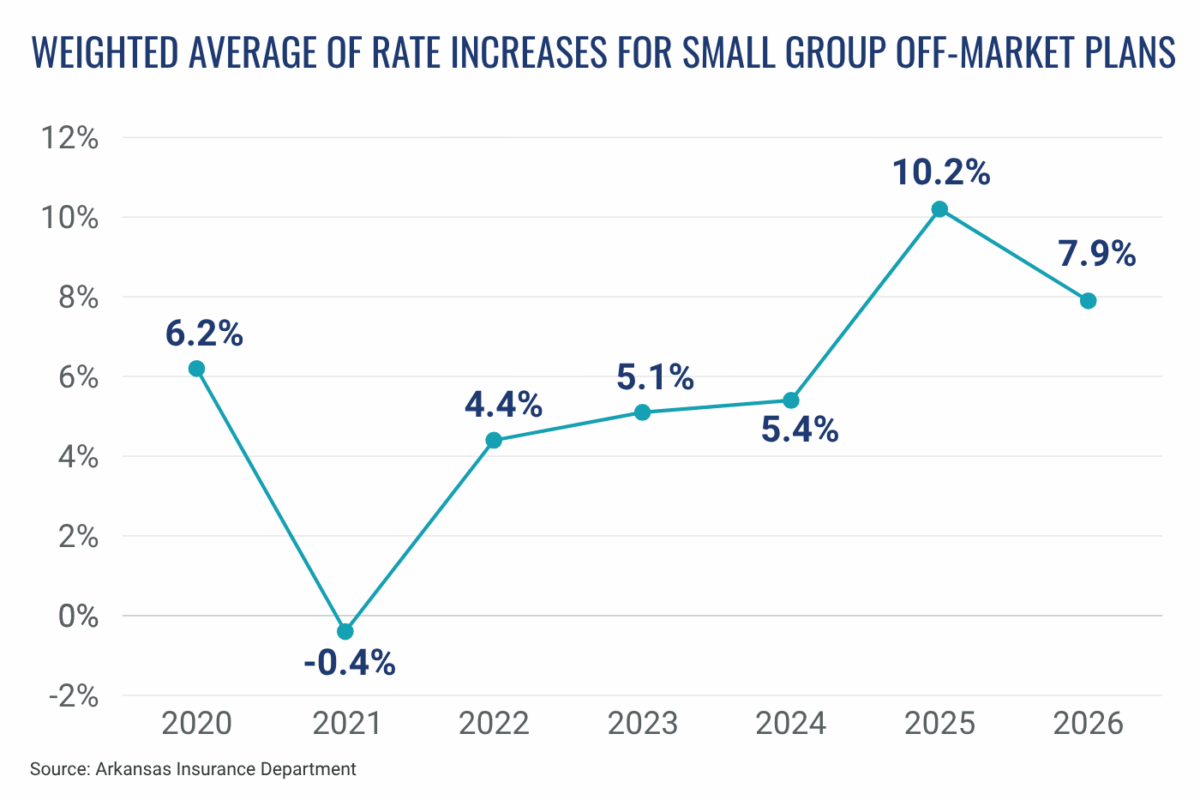

Insurers also proposed an average rate increase of 7.9% for small group off-market plans in June. Those proposed increases were unchanged in the August refile and were approved by AID without significant changes.

Insurers file proposed rate adjustments each year in response to market trends, changing healthcare costs, and policy shifts. In addition to these typical adjustments, filings from the insurance companies attribute the high rate increases for 2026 individual plans to recent federal and state policy changes. All six companies cite the expected expiration of enhanced premium tax credits for marketplace plans and the pending implementation of work requirements for adults in the Medicaid expansion program, among other federal actions, as reasons for the hikes. Arkansas laws mandating certain benefits, limiting prior authorizations, and regulating pharmacy benefit managers, all of which were approved in the 2025 legislative session, are also cited as major contributing factors. Across all insurers, the rationales for large rate increases in Arkansas broadly align with those of insurance companies across the nation.

The Arkansas insurers that increased their proposed rate changes in August cited worsening assumptions around morbidity and risk adjustment. In their filings, QCA Health Plan Inc. and QualChoice Life and Health Insurance Company Inc. — both subsidiaries of Centene — cited pharmacy dispensing fees as an additional factor, likely in reference to Arkansas’s new rule allowing the state insurance commissioner to require plans to include dispensing fees in pharmacy reimbursements.

Under state law, AID reviews insurers’ proposed rates to ensure that plans are priced appropriately. The state insurance commissioner must deny any rate that is deemed excessive, inadequate, or unfairly discriminatory.

Below are the proposed rate filings for 2026 plans that comply with the requirements of the federal Affordable Care Act. These include individual plans offered through the Arkansas Health Insurance Marketplace and individual and small group plans offered outside the marketplace.

Individual On- and Off-Market Plans

| Company Name | Enrollees | Market Share | Average Change Requested, Original June Filing | Average Change Requested, August 6 Refiling | Average Change Approved |

|---|---|---|---|---|---|

| Celtic Insurance Company (Ambetter) | 85,093 | 24.1% | 20.1% | 42.5% | 26.1% |

| QCA Health Plan Inc. | 52,505 | 14.9% | 30.1% | 54.2% | 27.5% |

| HMO Partners Inc. d/b/a Health Advantage | 28,447 | 8.1% | 20.9% | 20.23% | 12.32% |

| QualChoice Life and Health Insurance Company Inc. | 40,004 | 11.3% | 30.7% | 54.4% | 29.8% |

| USAble Mutual Insurance Co. (Arkansas Blue Cross and Blue Shield) | 106,042 | 30.1% | 25.77% | 23.3% | 16.85% |

| USAble HMO Inc. | 40,541 | 11.5% | 34.29% | 25.5% | 20.56% |

| Total | 352,672 | 100% | |||

| Weighted Average | 26.2% | 36.1% | 22.2% |

Small Group Off-Market Plans

| Company Name | Enrollees | Market Share | Average Change Requested |

|---|---|---|---|

| QCA Health Plan Inc. | 6,054 | 10.4% | 12.92% |

| UnitedHealthcare Insurance Company of the River Valley | 3,781 | 6.5% | -0.08% |

| UnitedHealthcare Insurance Company | 711 | 1.2% | 0.1% |

| QualChoice Life and Health Insurance Company | 4,104 | 7% | 13.1% |

| Arkansas Blue Cross and Blue Shield | 43,830 | 74.9% | 7.55% |

| Total | 58,480 | 100% | |

| Weighted Average | 7.9% |

While much lower than the proposed increases, the approved 22.2% average rate hike for individual market plans for 2026 surpasses all previous publicly posted rate hikes, including the 6.2% average increase approved for 2025, as shown below.

The 7.9% average rate increase proposed for small group plans in 2026 is lower than the 10.2% rate hike approved in 2025, but higher than average increases approved in other recent years, as shown below.

Rate filings for previous years can be found on the federal government’s Rate Review website.

Since 2017, Arkansas has had lower average monthly individual market premiums than any of the surrounding states. In 2025, Arkansas had the 16th-lowest marketplace benchmark premium in the nation.