The average benchmark premium on the Arkansas Health Insurance Marketplace increased by a higher percentage than any other state this year, a KFF analysis shows. This change, however, reflects a strategy by Arkansas insurers to mitigate the impact of the expiration of enhanced premium tax credits (PTCs) that have helped reduce the cost of health insurance premiums.

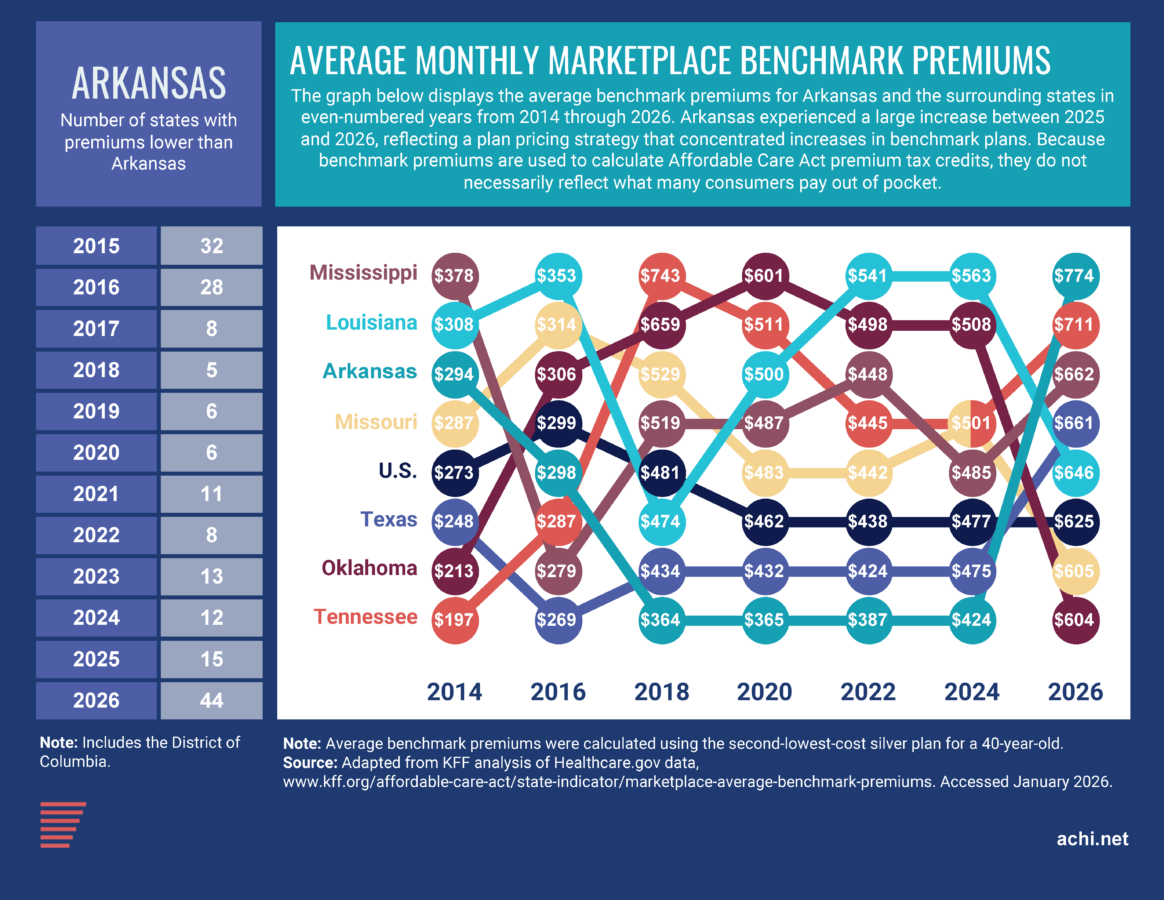

A benchmark premium is the monthly premium of the second-lowest priced silver-tier plan (the middle tier of coverage under the metal-tier system used to categorize marketplace plans) available to a consumer. In Arkansas, the average benchmark premium jumped from $458, the 16th lowest in the nation, in 2025 to $774, the seventh highest, this year. Benchmark premiums also increased in all but one other state, but the average increase nationwide was 26%, compared to a 69% increase in Arkansas.

A regional comparison shows that Arkansas’s average monthly benchmark premium was lower than those of the surrounding states during the years 2018 through 2025 but is now higher than the premium of any neighboring state.

Without context this may seem concerning, but the increase to Arkansas’s benchmark premium may counterintuitively protect some Arkansas consumers from increased premiums.

Arkansas’s Approach

Arkansas insurers concentrated premium increases for 2026 in benchmark silver plans, a pricing strategy often called “silver loading.” This approach optimizes the PTC calculation in order to reduce the cost of marketplace coverage for consumers with qualifying incomes. Because PTCs are calculated based on the benchmark silver premium in a consumer’s area, higher benchmark premiums result in larger credits. Those larger credits can be applied to bronze, gold, and platinum plans, even if the premiums of these plans do not increase by as much or at all. A KFF analysis of average premiums by metal tier shows that while the average benchmark premium rose by 69% in Arkansas this year, the average premium for the state’s lowest-cost bronze plan rose by 15%, compared to an average national increase of 20%, and the average premium for Arkansas’s lowest-cost gold plan rose by 23%, compared to a national average increase of 21%.

In effect, this approach can make non-silver plans more affordable for consumers who receive PTCs, while making silver plans less affordable for those who do not.

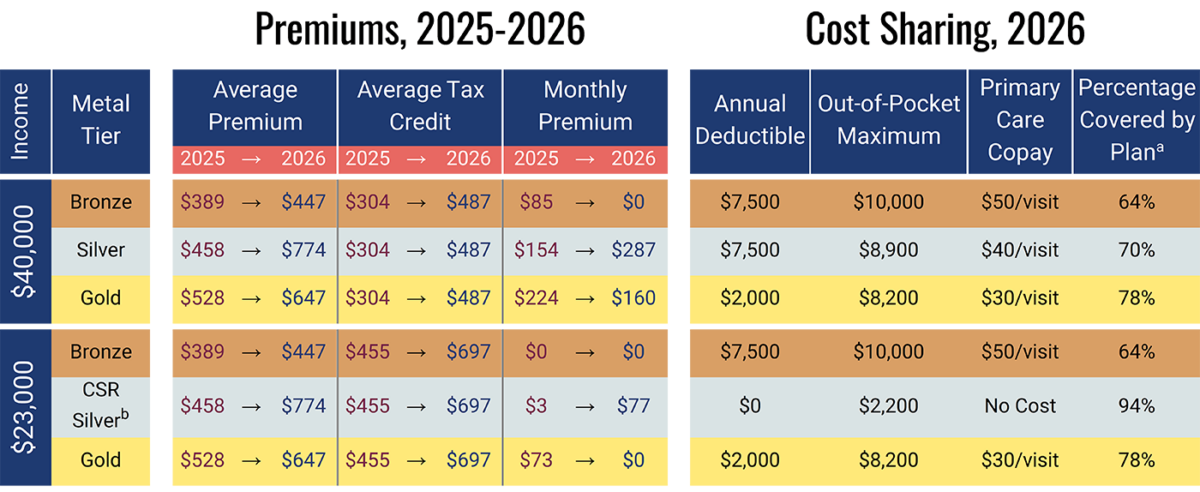

While PTCs reduce monthly costs for eligible consumers, plan choice is not determined by premiums alone. Consumers may consider bronze plans, which typically have lower monthly premiums but higher deductibles, or gold plans, which generally have lower deductibles and more predictable out-of-pocket costs. Lower-income enrollees may also qualify for cost-sharing reductions (CSRs), which lower deductibles and other out-of-pocket costs for enrollees on silver plans.

The graphic below estimates how the monthly premiums of the lowest-cost plans available in each metal tier on the Arkansas Health Insurance Marketplace may have changed this year for two hypothetical Arkansans, one with an annual salary of $40,000 and the other with an annual salary of $23,000. The graphic also shows cost-sharing factors for sample plans at those income levels. Premiums and tax credits given here are averages and may not necessarily reflect exact prices seen by applicable consumers. Note that, because of the expiration of the enhanced PTCs, Arkansans with annual incomes over $63,840, or 400% of the federal poverty level in 2026, receive no tax credit.

Sources: KFF analysis of average monthly premiums by metal tier; KFF Health Insurance Marketplace Calculator, 2025 and 2026; sampling of plans available on the Arkansas Health Insurance Marketplace in 2026.

a This percentage, also called an actuarial value, represents the portion of overall healthcare expenses the average enrollee can expect to be paid by an insurance plan, based on the plan’s deductible, out-of-pocket maximum, and copays/coinsurance rates.

b Silver CSR plans cover 94%, 87%, or 73% of healthcare expenses for individuals with incomes of 138%-150%, 151%-200%, or 201%-250% of the federal poverty level, respectively. An annual income of $23,000 is 144% of the 2026 federal poverty level and so qualifies for a CSR plan that covers 94% of expenses. An annual income of $40,000 is 251% of the 2026 federal poverty level and so does not qualify for a CSR plan.

Approaches in Other States

Several other states have taken other, more direct actions to mitigate the impact of the expiration of the enhanced PTCs. New Mexico opted to cover the lost credits in full for all consumers — including those with incomes over 400% of the FPL — using state funds. Some states, such as Colorado and Maryland, established new programs that partially cover the lost credits for all consumers up to 400% of the FPL. Connecticut introduced a program that covers the credits in full for those with incomes between 100% and 200% of the FPL, and in part for those with incomes between 400% and 500% of the FPL.

Other states, such as California, chose to cover the lost credits for a limited portion of enrollees by expanding existing state-level subsidy programs. The District of Columbia created a publicly administered basic health plan for low-income residents, mirroring similar programs in New York, Minnesota, and Oregon.

Data are not yet available to analyze how premium differences between plan tiers changed across the country following the expiration of the enhanced PTCs, nor to assess movement between plan tiers in response. More complete enrollment and premium data will be needed to evaluate consumer plan selection and out-of-pocket costs.