On November 14, the Centers for Medicare and Medicaid Services (CMS) announced increased monthly premiums, annual deductibles, and coinsurance rates for Medicare parts A and B for 2026. The increases are slightly higher than the increases from 2024 to 2025, but still within typical year-to-year variation.

Medicare is the federal government’s health insurance program for older adults and individuals with qualifying disabilities. The program is divided into four parts, each with different scopes of coverage.

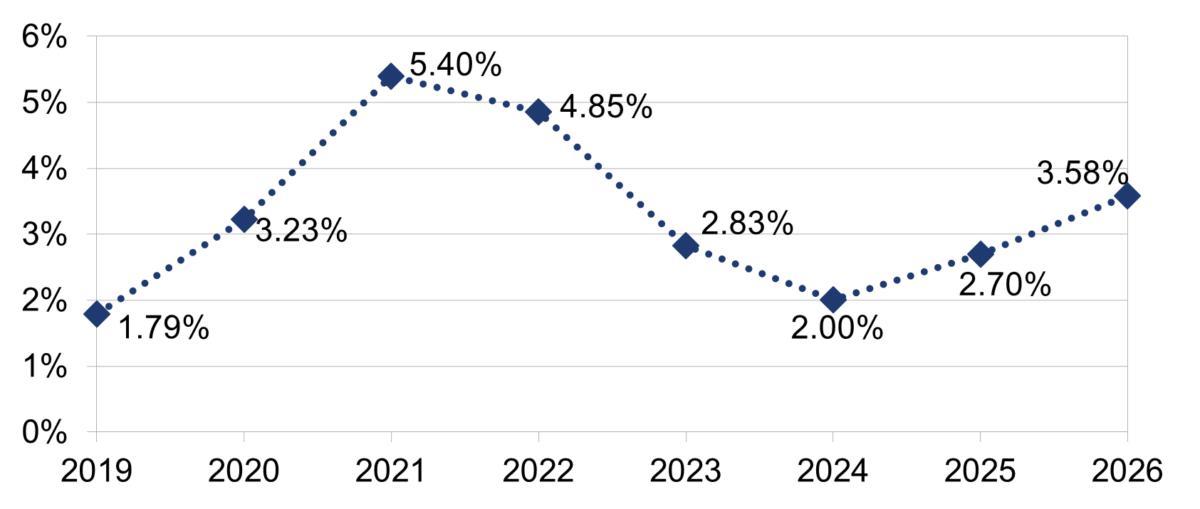

Medicare Part A is hospital insurance, which covers inpatient care such as hospital stays. Nearly all Medicare beneficiaries do not pay a Part A premium. Part A deductibles and coinsurance will increase by 3.58% in 2026. The dollar amounts of the increases are shown below.

2026 Part A Deductible and Coinsurance Increases

| 2025 | 2026 | Change | |

|---|---|---|---|

| Inpatient Hospital Deductible | $1,676 | $1,736 | + $60 |

| Daily Hospital Coinsurance for 61st-90th Day* | $419 | $434 | + $15 |

| Daily Hospital Coinsurance for Lifetime Reserve Days | $838 | $868 | + $30 |

| Skilled Nursing Facility Daily Coinsurance | $209.50 | $217 | + $7.50 |

*Medicare pays for the first 60 days of inpatient care after the deductible is met. Days 61-90 are partially covered. Medicare also provides partial coverage for 60 “reserve days” that enrollees can use at any time in their lives; this coverage can be used for hospital stays that extend beyond 90 days. After reserve days are exhausted, enrollees are responsible for all costs. Care at skilled nursing facilities is covered separately.

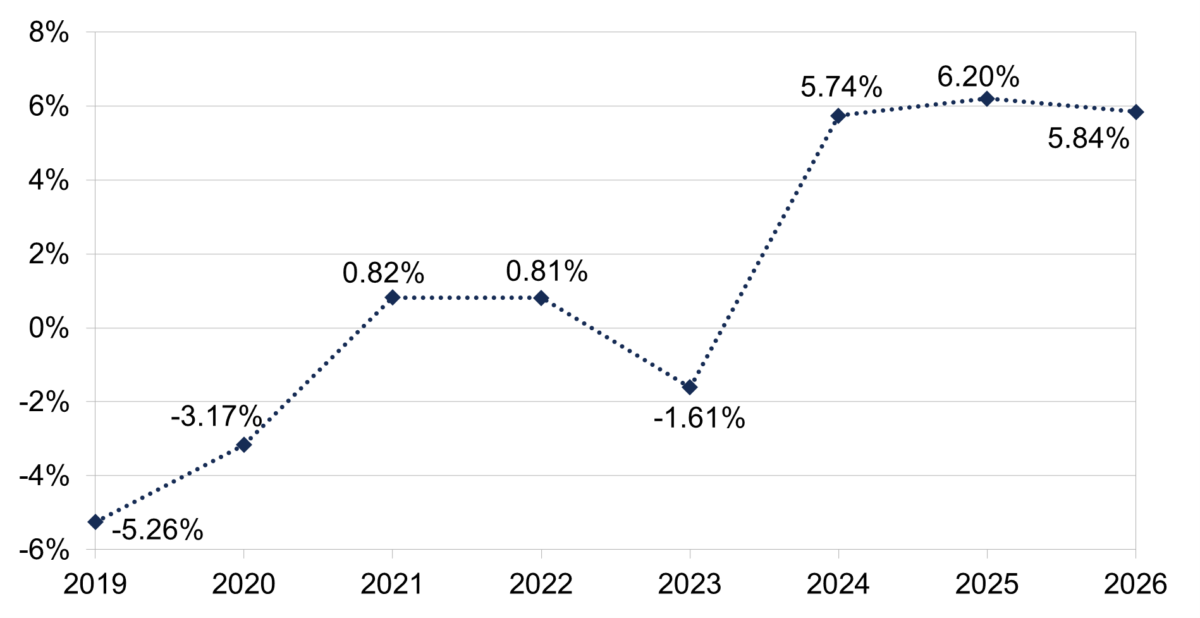

The 3.58% increase in Part A deductibles and coinsurance is slightly more than last year’s 2.7% increase.

Part A Deductible and Coinsurance Percentage Increases, 2019-2026

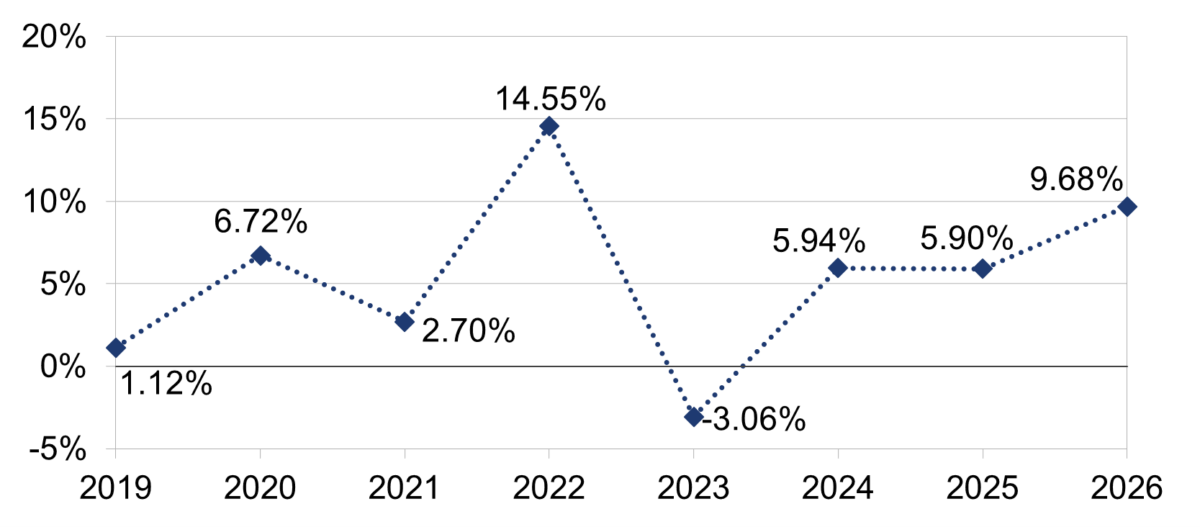

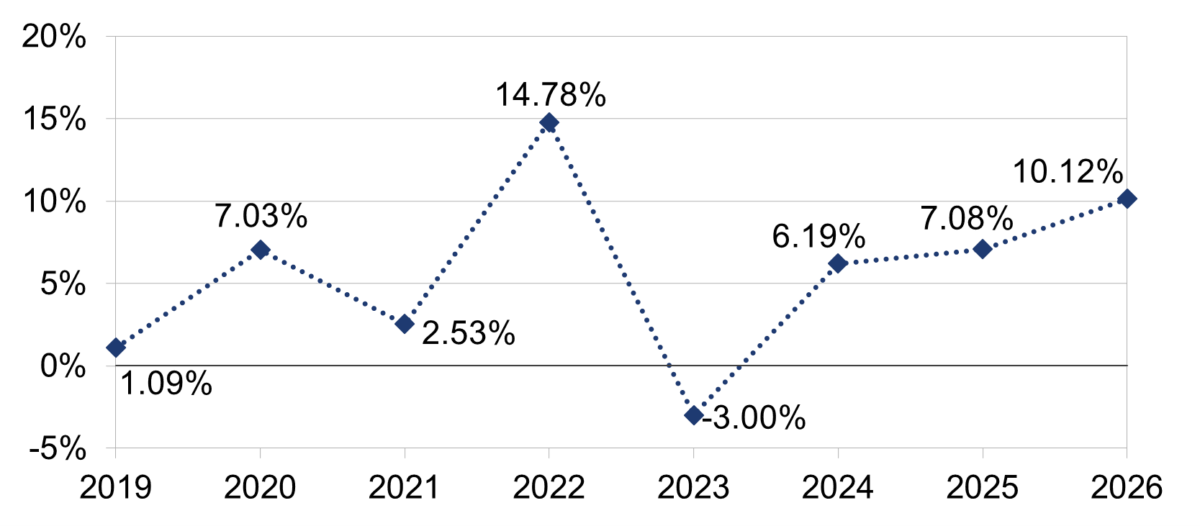

Medicare Part B is medical insurance, which covers outpatient care such as primary care visits. Part B enrollees pay a monthly premium and have a small deductible. The Part B standard premium and deductible are set to increase by 9.68% and 10.12%, respectively.

2026 Part B Premium and Deductible Increases

| 2025 | 2026 | Change | |

|---|---|---|---|

| Standard Monthly Premium | $185 | $202.90 | + $17.90 |

| Annual Deductible | $257 | $283 | + $26 |

As with Part A, the Part B increases for 2026 are larger than the increases in 2025.

Part B Premium Percentage Increases, 2019-2026

Part B Deductible Percentage Increases, 2019-2026

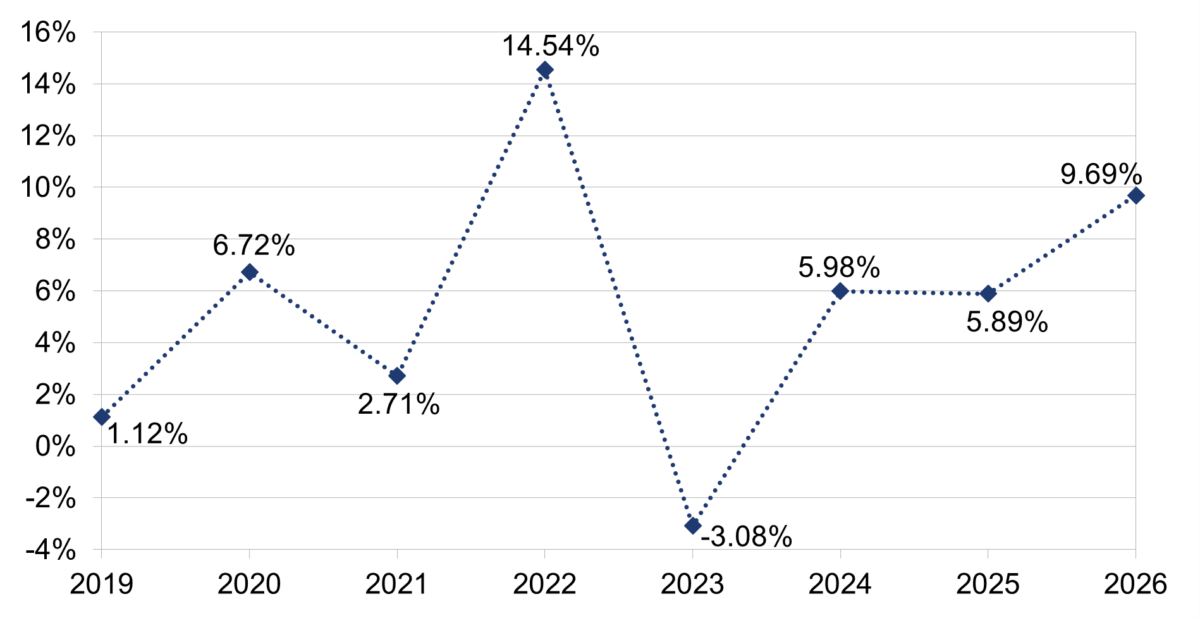

Medicare Part D is prescription drug coverage, which pays for medications taken outside of a hospital or doctor’s office. CMS announced that income-related adjustments to the parts B and D monthly premiums, which apply to several brackets of higher-income beneficiaries, are also increasing in 2026.

Part B Income-Related Adjustment Percentage Increases, 2019-2026

Part D Income-Related Adjustment Percentage Increases, 2019-2026

As Medicare beneficiaries weigh their enrollment options, the rising cost of parts A and B may complicate a process that many already find confusing. In particular, the increasing Part B premium may push some beneficiaries to consider Medicare Advantage plans that offer a “giveback” benefit, in which the insurer pays for some or all of an enrollee’s Part B premium, often at the expense of a narrower provider network or weaker benefits. Medicare Part C authorizes the offering of Medicare Advantage plans, which provide benefits offered in Medicare Parts A and B and frequently provide additional benefits such as dental and vision.

2026 Medicare open enrollment closes on December 7, after which coverage changes cannot be made until next year’s open enrollment period unless an enrollee experiences a qualifying life event.