determining the health of tomorrow

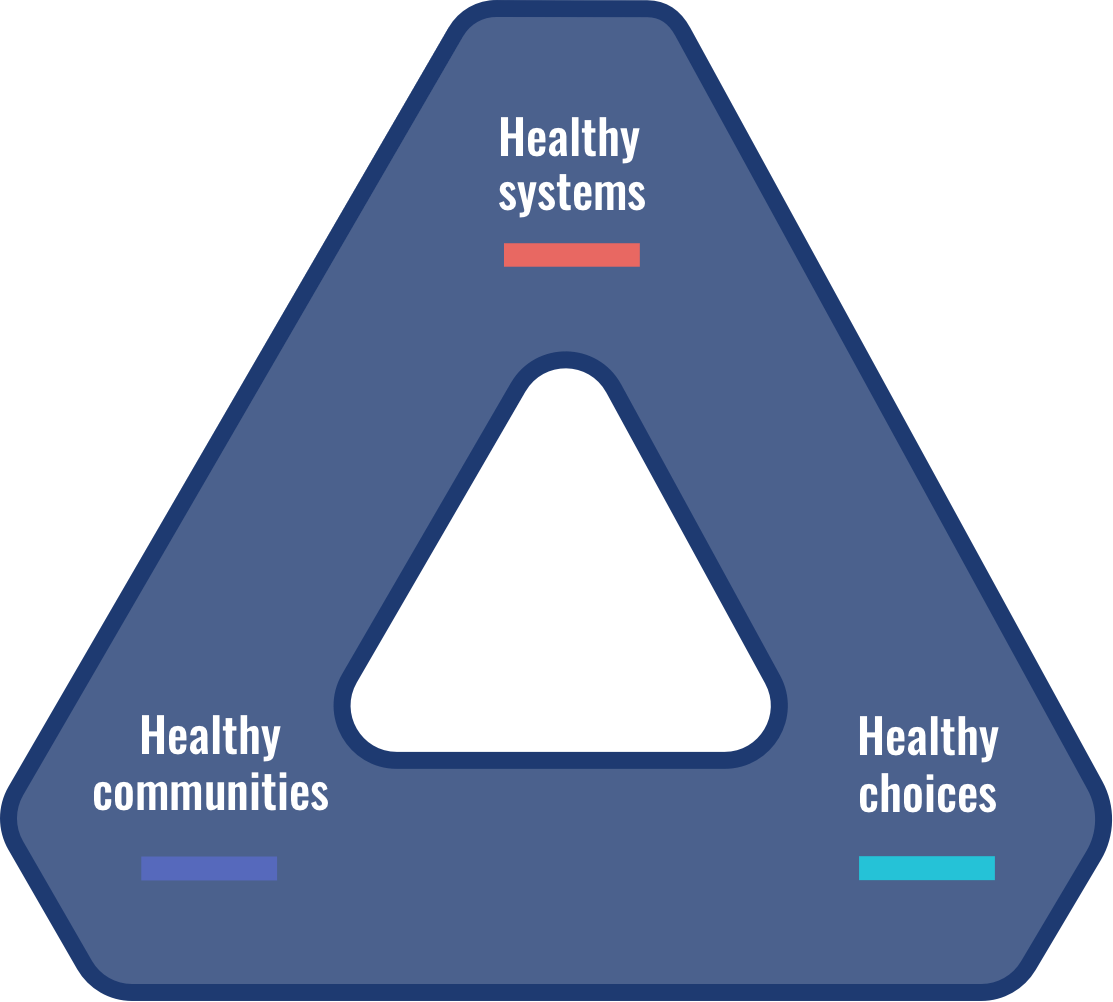

We have the courage to catalyze change. As a health policy accelerator driven to improve the wellbeing of the people, we shape essential systems, remove community barriers, and inform individual choices

22%

OBESITY RATE FOR ARKANSAS PUBLIC SCHOOL CHILDREN

250,000

ARKANSANS GAINED HEALTH COVERAGE SINCE 2013

#7

ARKANSAS NATIONAL RANKING, ADULT OBESITY

Healthy Systems

Culturally-informed solutions and accessible opportunity are essential for health.

Healthy Communities

A balance of quality care, equitable practices, and affordable methods is essential for health.

Healthy Choices

Culturally-informed solutions and accessible opportunity are essential for health.

OUR CAPABILITIES

We are data stewards, research scientists, and policy wonks. Our experts possess all of the capabilities needed to produce actionable solutions in one house.